Will Fannie Mae’s Secret ‘Blacklist’ Destroy Miami Condo Pricing?

How much does a South Florida condo cost?

This simple question has become much more complicated to compute within the last month due to revelations that a secret Fannie Mae “blacklist” exists to identify high-risk projects to avoid by residential lenders that offer conventional financing to borrowers.

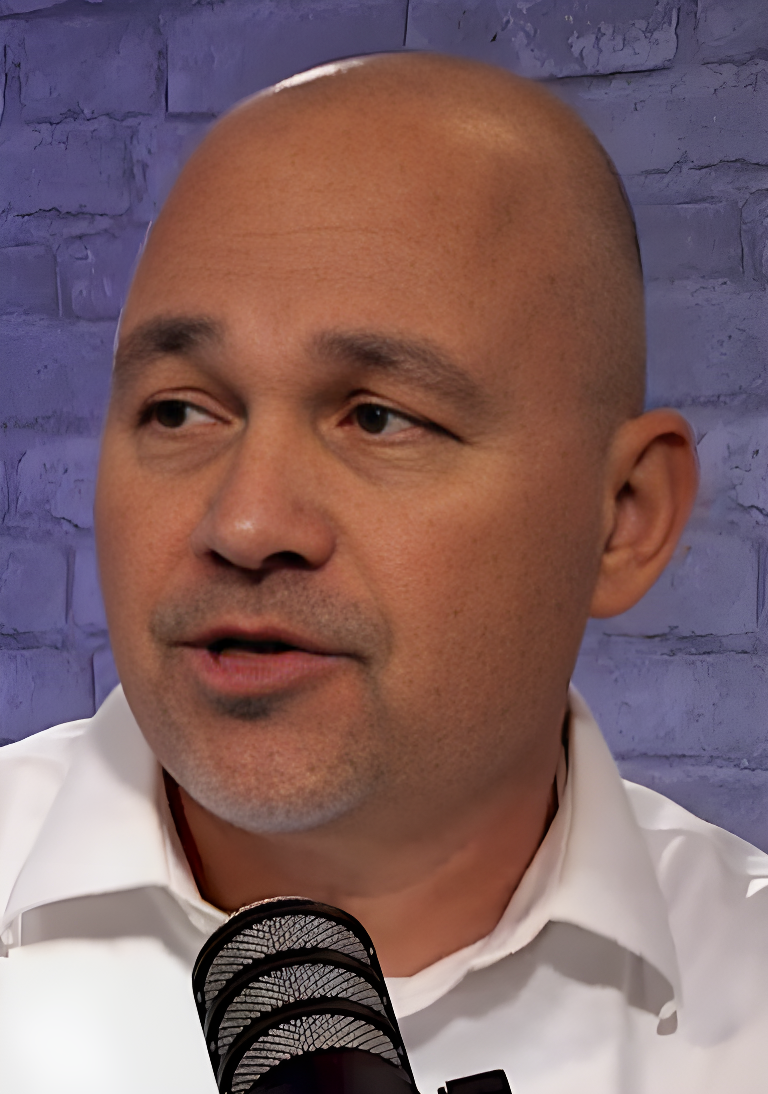

“If the asking price on that South Florida condo you are considering buying seems like good value, you should not think that you are smarter than everyone else in the market,” said Miami condo expert Peter Zalewski of CondoVultures.com. “What you should consider is, someone with inside information who wants out of a condo project before troubling news breaks is desperate to find an unsuspecting buyer, i.e., a sucker. The downside risk is significant for all Miami condo buyers until the so-called ‘blacklist’ is published for all to see and not just the well connected.

“This situation reminds me of the old idiom about ‘rats fleeing a sinking ship.'”

Pricing used to depend primarily on buyers, sellers and market conditions. A great unknown, however, was introduced in December 2023 with confirmation that the $4.3 billion mortgage lender Fannie Mae has a long-rumored “blacklist” of condo projects that are not financeable, according to a recent press report from the Miami Herald.

The list will presumably be considered material information by many industry watchers as market pricing will likely have to adjust for those condominiums that have been deemed a high risk by Fannie Mae.

Some 250 South Florida condo projects are reportedly on the list, making nearly all of them unfinanceable by conventional measures. This designation means borrowers who hope to buy or refinance units in these “blacklisted” projects will probably have to seek out financing from private lenders – if they can get it.

Private financing – commonly referred to by some as “hard money lending” – is generally more expensive. In addition to requiring larger deposits, hard money lenders typically charge higher interest rates, prepayment penalties and junk fees for unconventional loans.

Condo owners in “blacklisted” projects who are struggling to pay their mortgages may have few options for relief, raising the potential for foreclosures and deep discounts being offered to cash buyers.

Fannie Mae – which professes that it “provides liquidity to the U.S. housing finance market primarily by securitizing mortgage loans on residential properties into mortgage-backed securities that we guarantee” – has reportedly announced that it would “make its secret ‘Condo Unavailable Projects and Phases Report’ public” later this year in 2024, according to the Boston Globe.

In 2024, CondoVultures.com plans to monitor all things related to condo associations in South Florida.

For nearly 15 years, we have discussed the need for a rating agency approach – modeled after Wall Street – to evaluate the financial health of the thousands of condo associations that exist in Florida. It would be much easier to do today than it was more than a decade ago given the advancement in big data and the potential for artificial intelligence.

Property management companies and condo associations have always resisted the idea for a number of reasons, including losing their competitive advantage as a result of disclosing material information about the financial health of their respective communities.

Think about it, well-run condo associations – much like publicly traded companies – could garner higher prices on the resale market while poorly-run communities could be penalized, in terms, of valuations.

It was not until the June 2021 collapse of the Champlain Tower South condominium in the barrier island city of Surfside in Miami-Dade County that people took notice. New Florida legislation, heightened governmental scrutiny and demands by the insurance industry could make this moment that condo associations are finally forced to reveal what they are doing and why.

Given our mission of bringing straight talk to South Florida’s overhyped South Florida real estate market, we think this could finally be the time to pursue the launch of what we call the CondoRatingsAgency.com.

For more information, please visit CondoVultures.com, follow us on social media (@CondoVultures), check out our YouTube channel (@CondoVultures) and sign up for our Substack newsletter

Published by Peter Zalewski

Published by Peter Zalewski

1/3/2024

1/3/2024  6:18:36 PM

6:18:36 PM