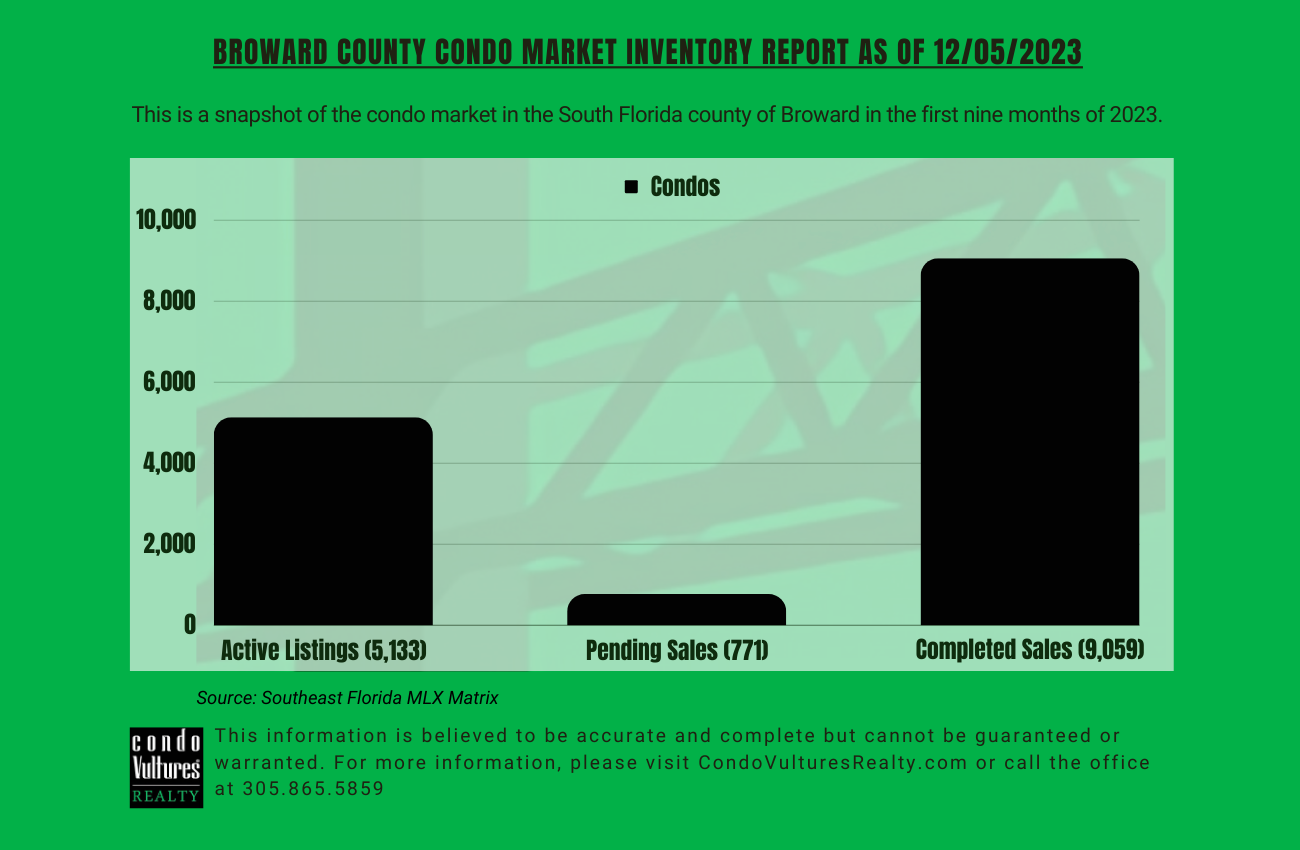

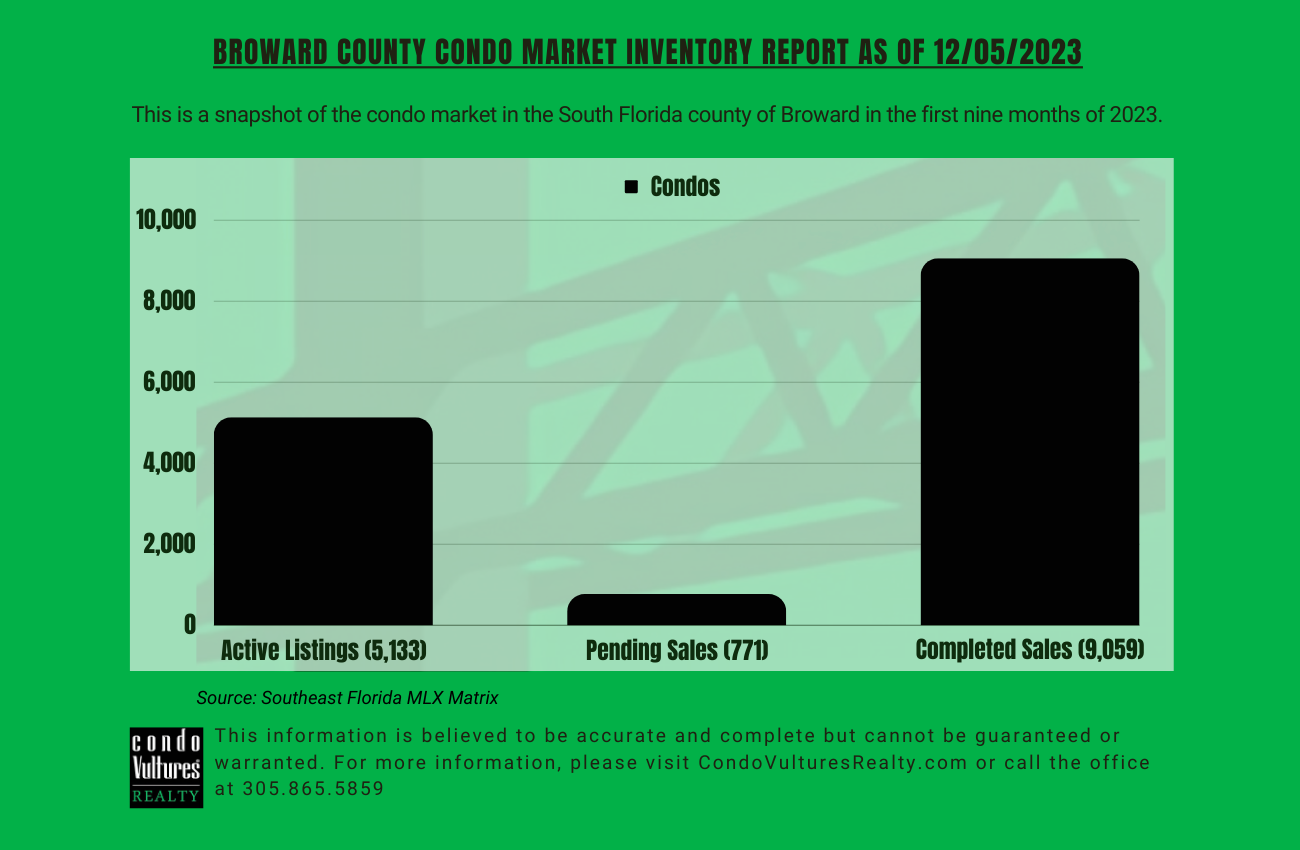

Broward County is in a sellers market for condos with about 5.1 months of supply currently listed for sale at the start of the South Florida Winter Buying Season that generally stretches from November through April, according to an analysis by CondoVulturesRealty.com.

In the first nine months of 2023, buyers purchased an average of nearly 1,007 units per month for a total of nearly 9,060 units between January and September.

Based on the currently actively listings in the Multiple Listing Service – a database used by Realtors to market condos – the market is currently at equilibrium – but headed toward a buyers market – based on the supply available for purchase.

Generally, six months of supply is considered equilibrium for the housing market. Less months indicates a sellers market and more months points to a buyers market from a negotiating perspective.

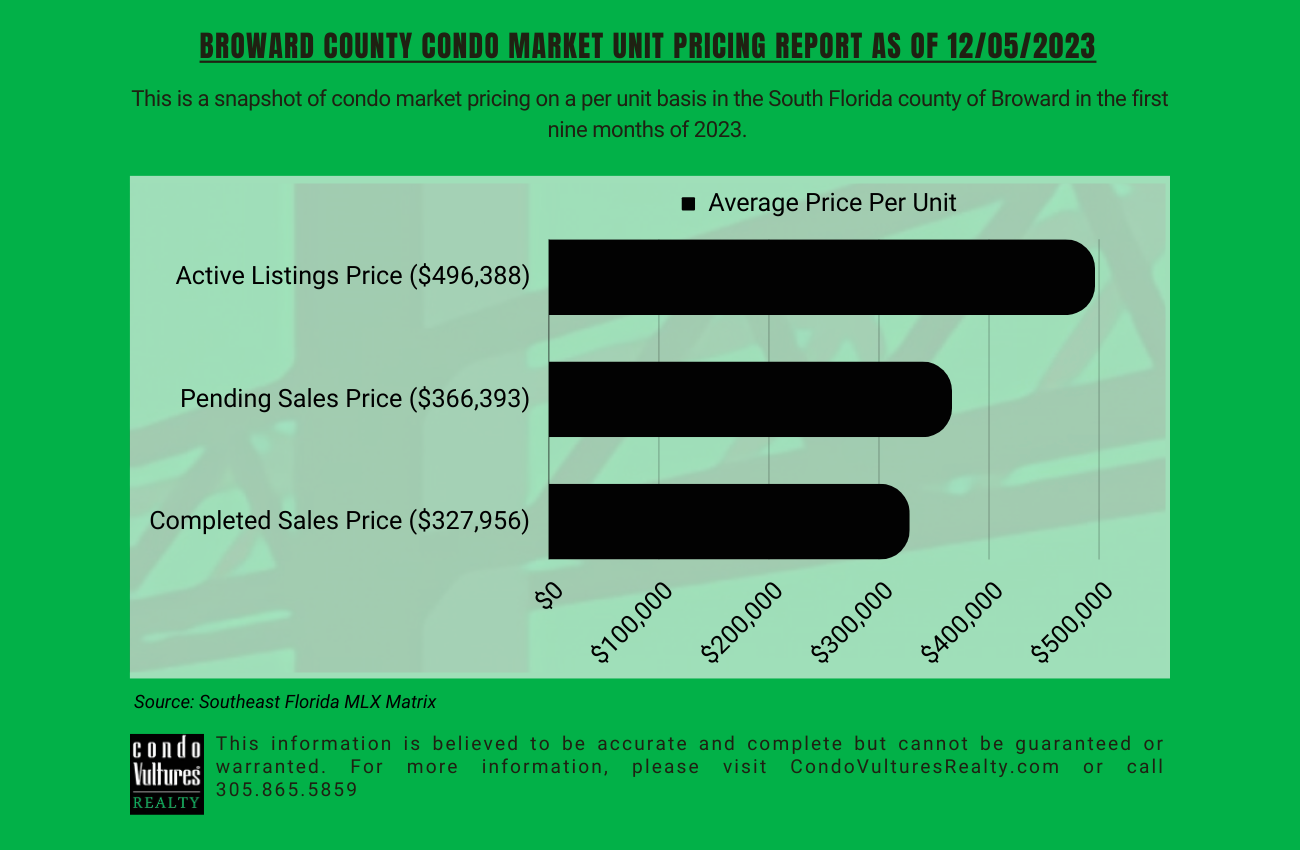

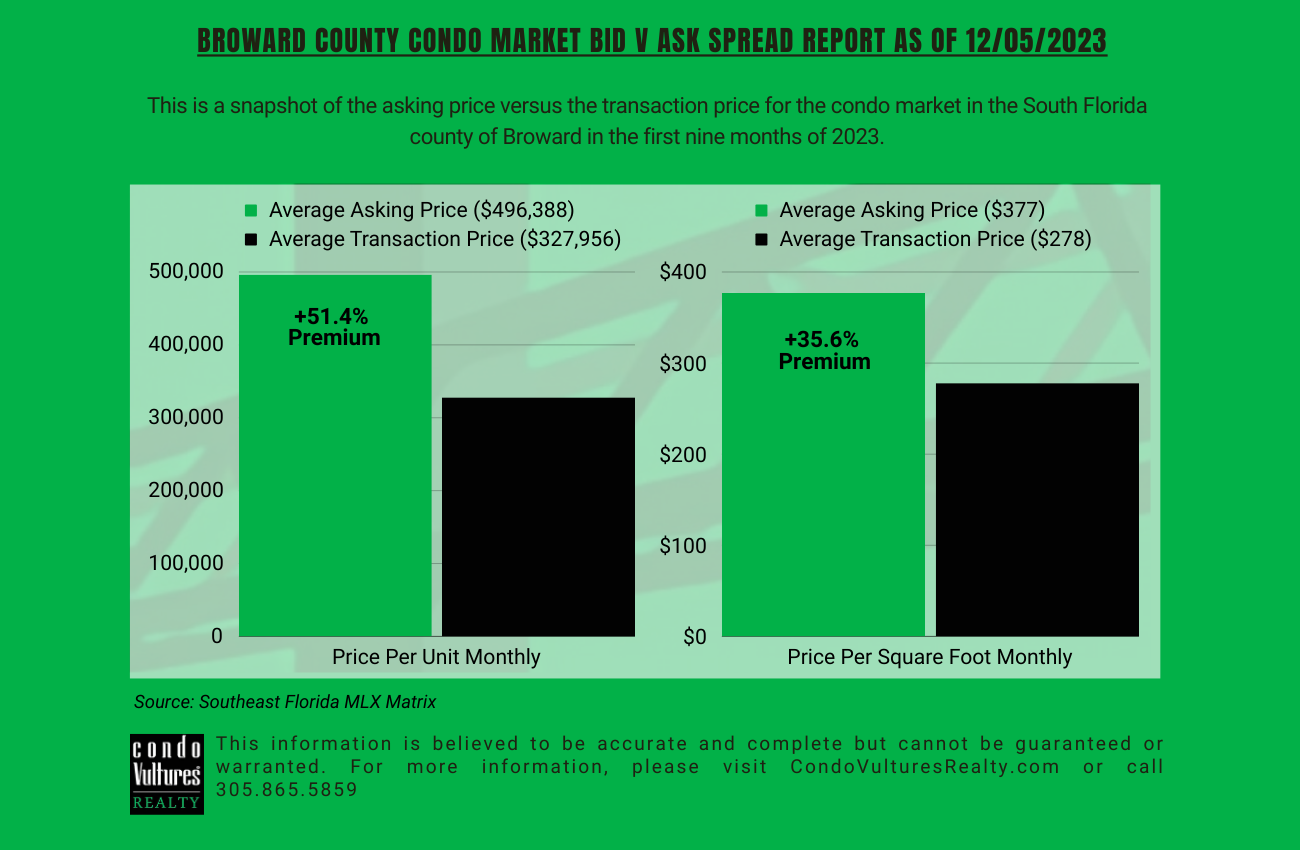

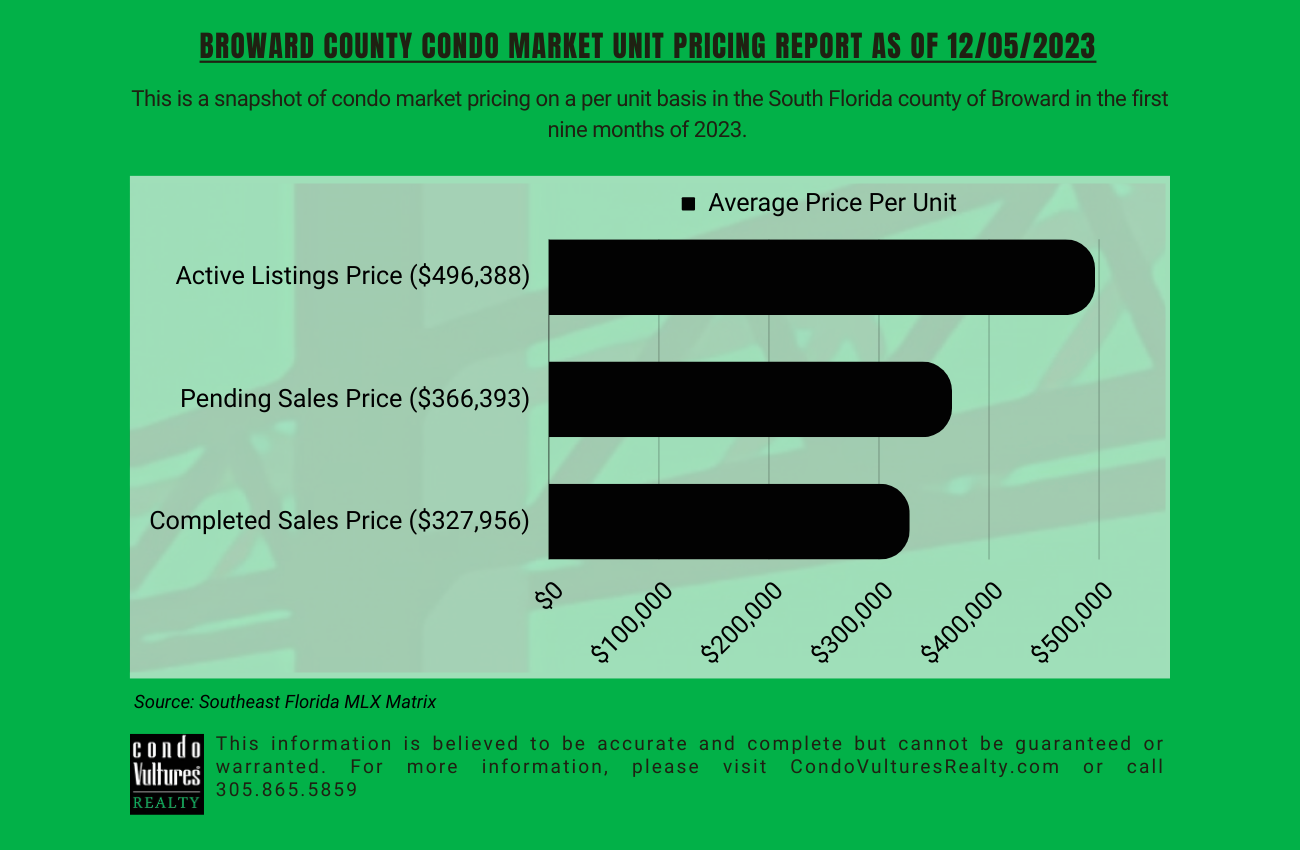

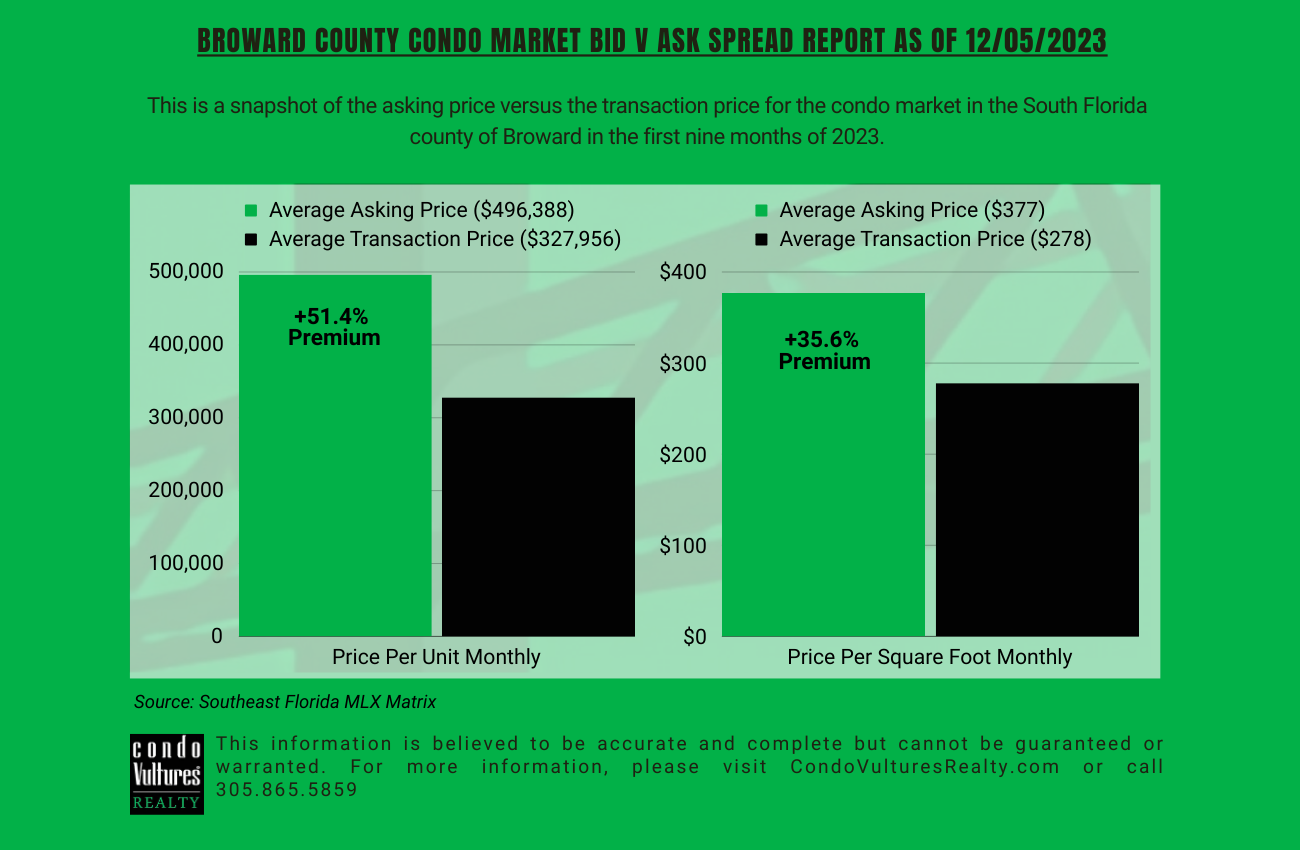

Currently, the average asking price for a condo is $496,388 per unit compared to an average sales price of $327,956 per unit. Pending sales went under contract at an average asking price of $366,393 per unit.

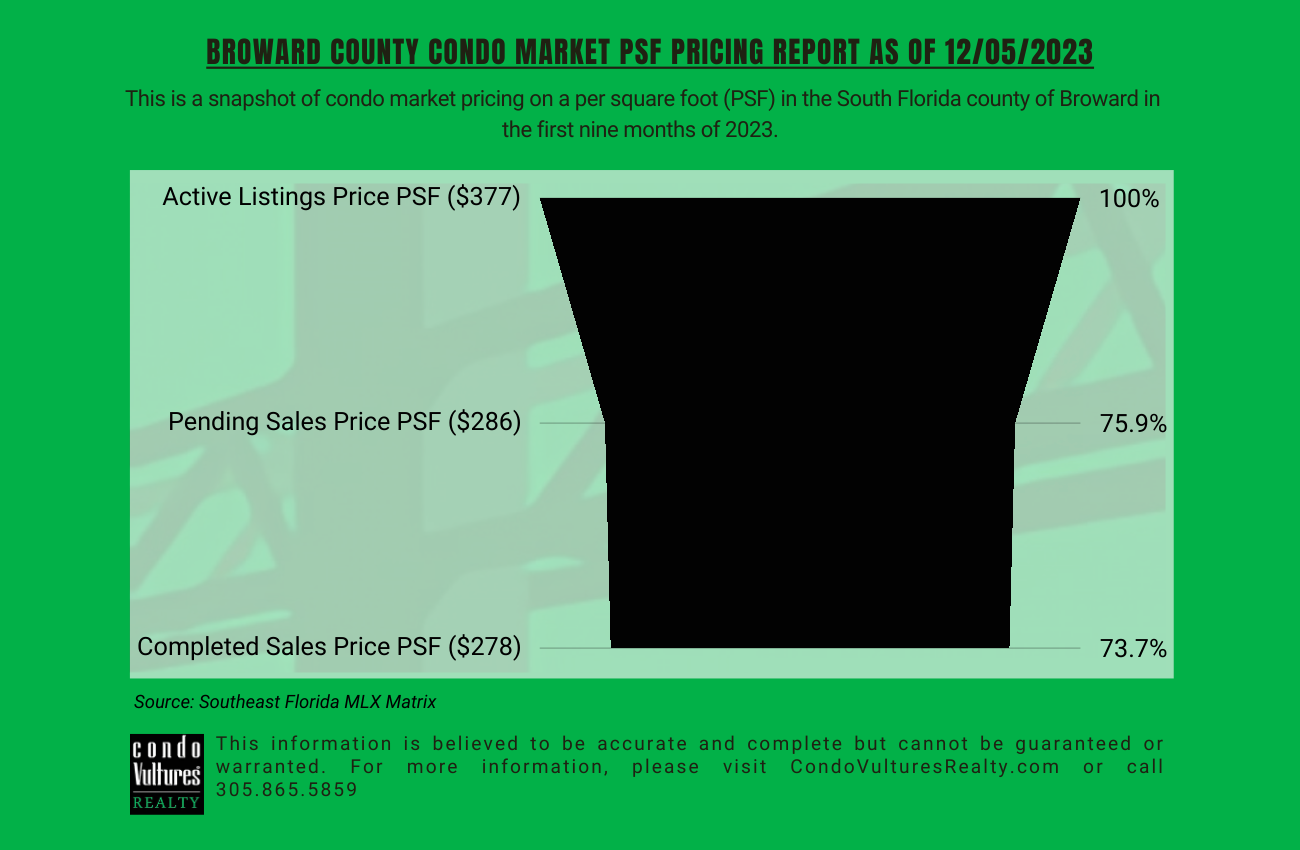

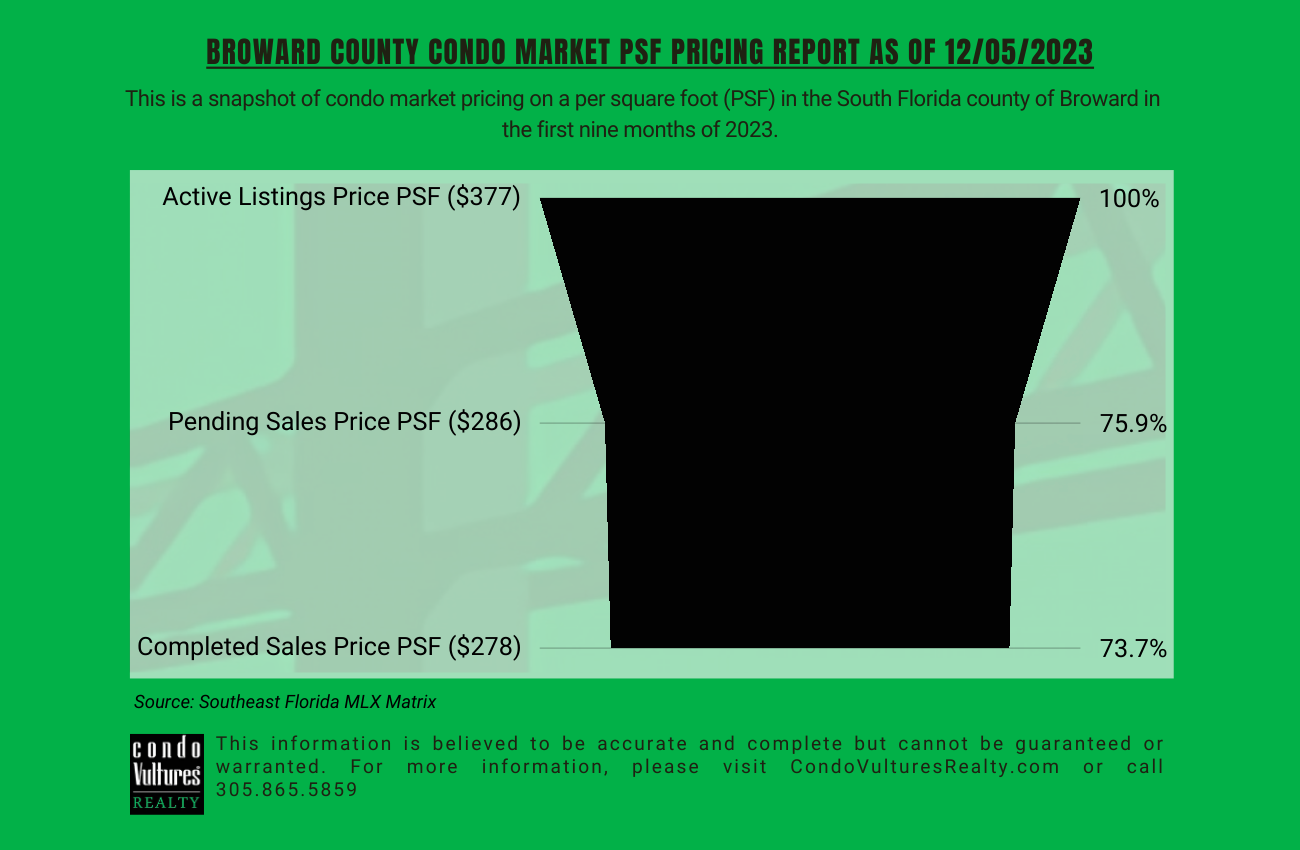

On a price per square foot basis, the average asking price for a condo is $377 psf compared to an average sales price of $278 psf. Pending sales went under contract at an average asking price of $286 psf.

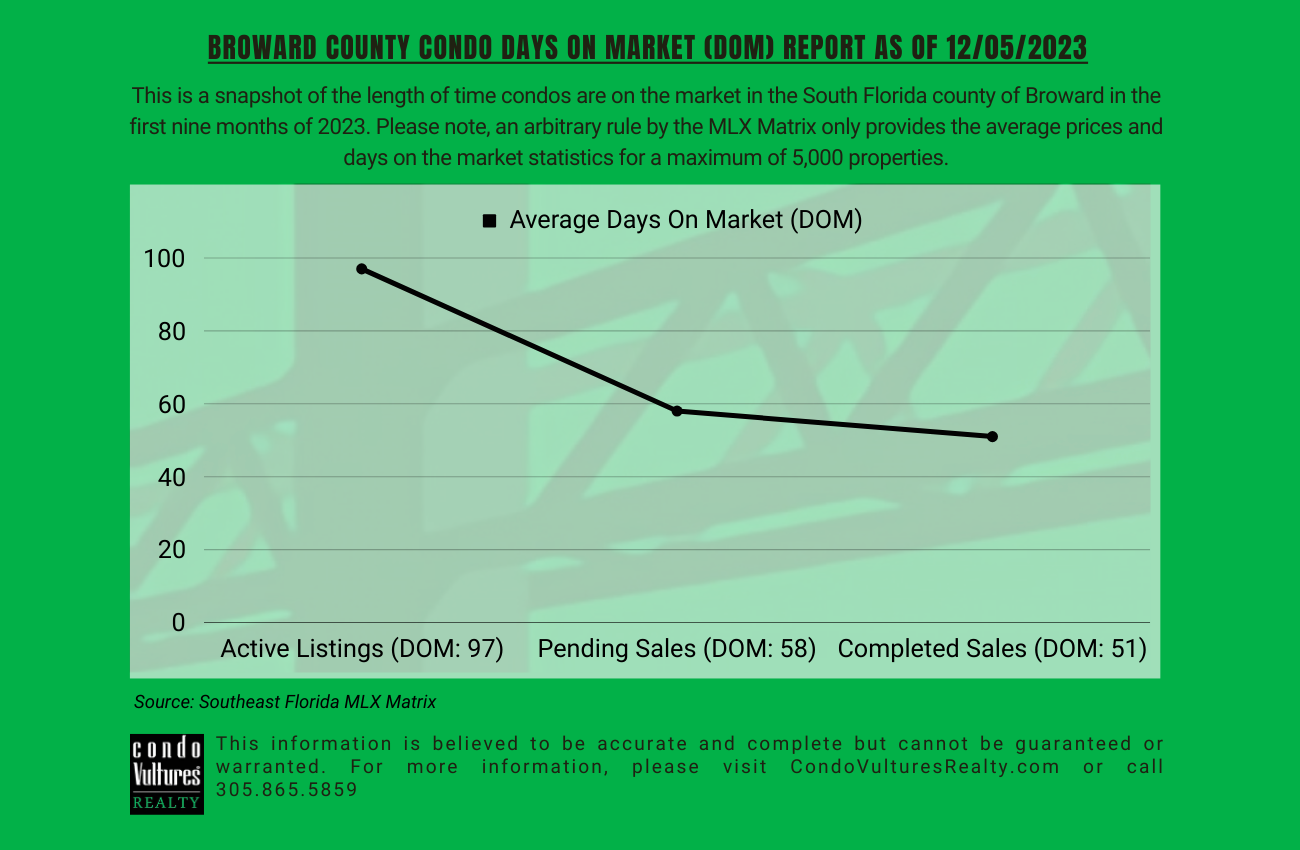

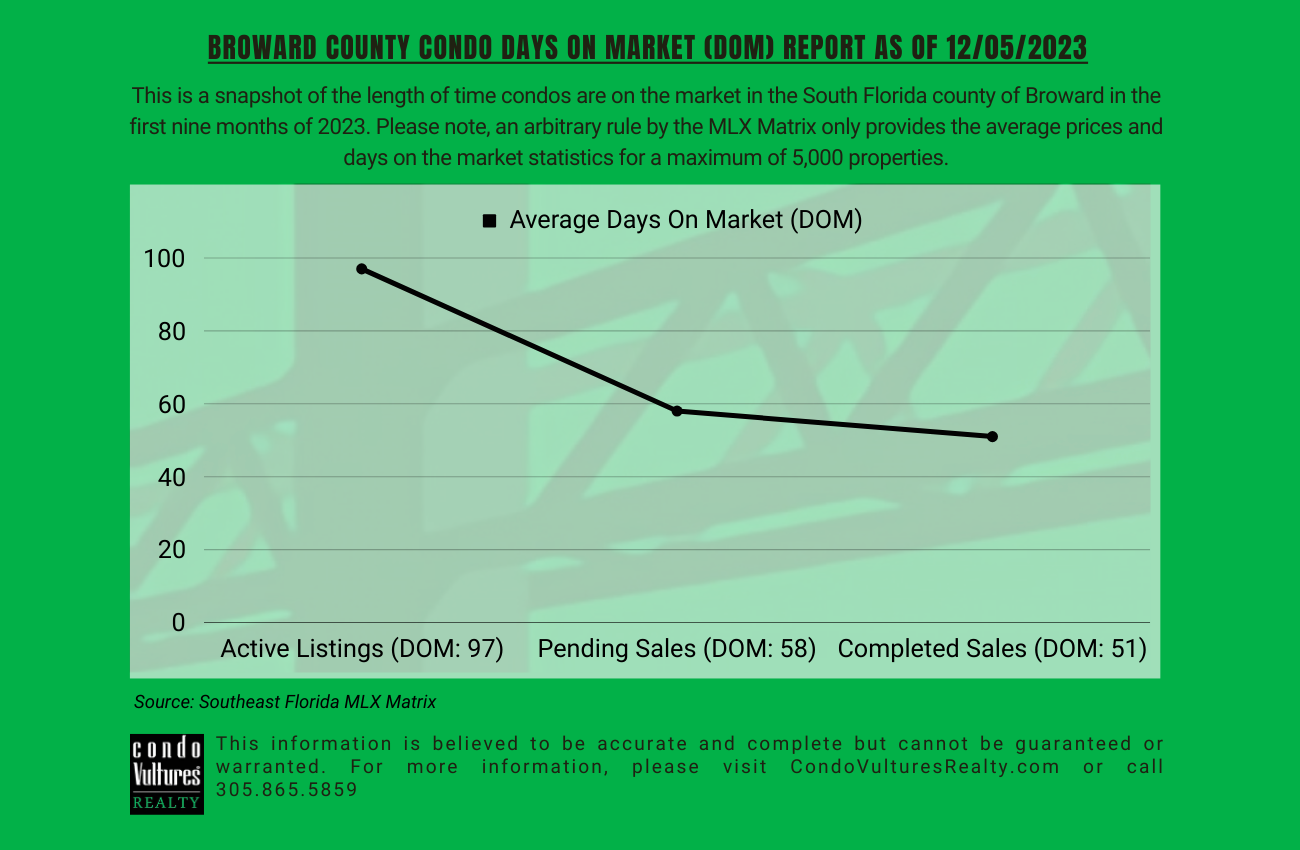

To gauge buyer sentiment, we focus on the Days On Market (DOM) category to better understand how purchasers are proceeding. If buyers are optimistic, the number of days an active listing is on the market should be similar or less than the average period of time for deals to date. If buyers are bearish, the DOM category will show active listing sitting on the market longer.

To gauge seller sentiment, we focus on the spread between the average asking price and the average transaction price on a per unit and per square foot basis. Generally, a spread of up to 20 percent suggests that a seller is willing to negotiate to complete a deal. Anything greater than 20 percent suggests that sellers are overly bullish on their prospects of selling their units at a premium.

This information is believed to be accurate and complete but cannot be guaranteed or warranted. For more information, please call 305.865.5859 or visit CondoVulturesRealty.com

For more information, please visit CondoVultures.com and sign up for our Substack newsletter

|

Broward County Condo Market Velocity Report As Of 12/05/2023

|

| This is a snapshot of the condo market in Broward County in South Florida in the first nine months of 2023. Please note, an arbitrary rule by the MLX Matrix only provides the average prices and days on the market statistics for a maximum of 5,000 properties. |

| This information was compiled by CondoVulturesRealty.com. It is believed to be accurate and complete but cannot be guaranteed or warranted. For more information, please call 305.865.5859 |

|

Units |

Average Price Per Unit |

Average Price Per Square Foot |

Average Days On Market (DOM) |

| Current Active Listings |

5,133 |

$496,388 |

$377 |

97 |

| Current Pending Sales |

771 |

$366,393 |

$286 |

58 |

| First Nine Months Of 2023 Completed Sales (January Through September) |

9,059 |

$327,956 |

$278 |

51 |

| Active Listings v First Nine Months Of 2023 Completed Sales Spread |

|

51.4% |

35.6% |

90.2% |

| Average Monthly Sales Completed In The First Nine Months Of 2023 |

1,006.6 |

|

|

|

| Average Months Of Supply Currently Actively Listed |

5.1 |

|

|

|

| Source: Southeast Florida MLX Matrix |

Published by Peter Zalewski

Published by Peter Zalewski

12/5/2023

12/5/2023  9:54:37 PM

9:54:37 PM